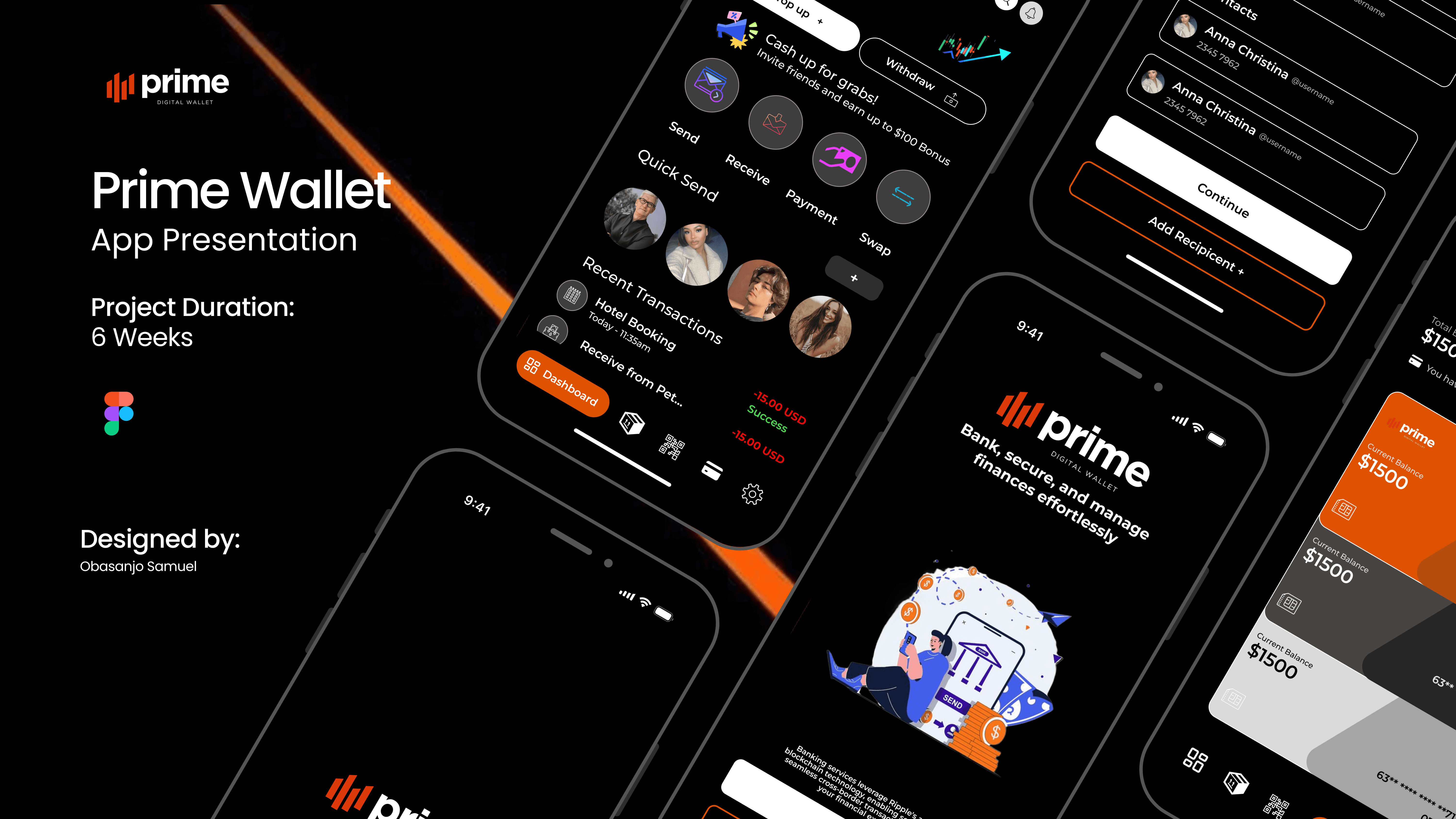

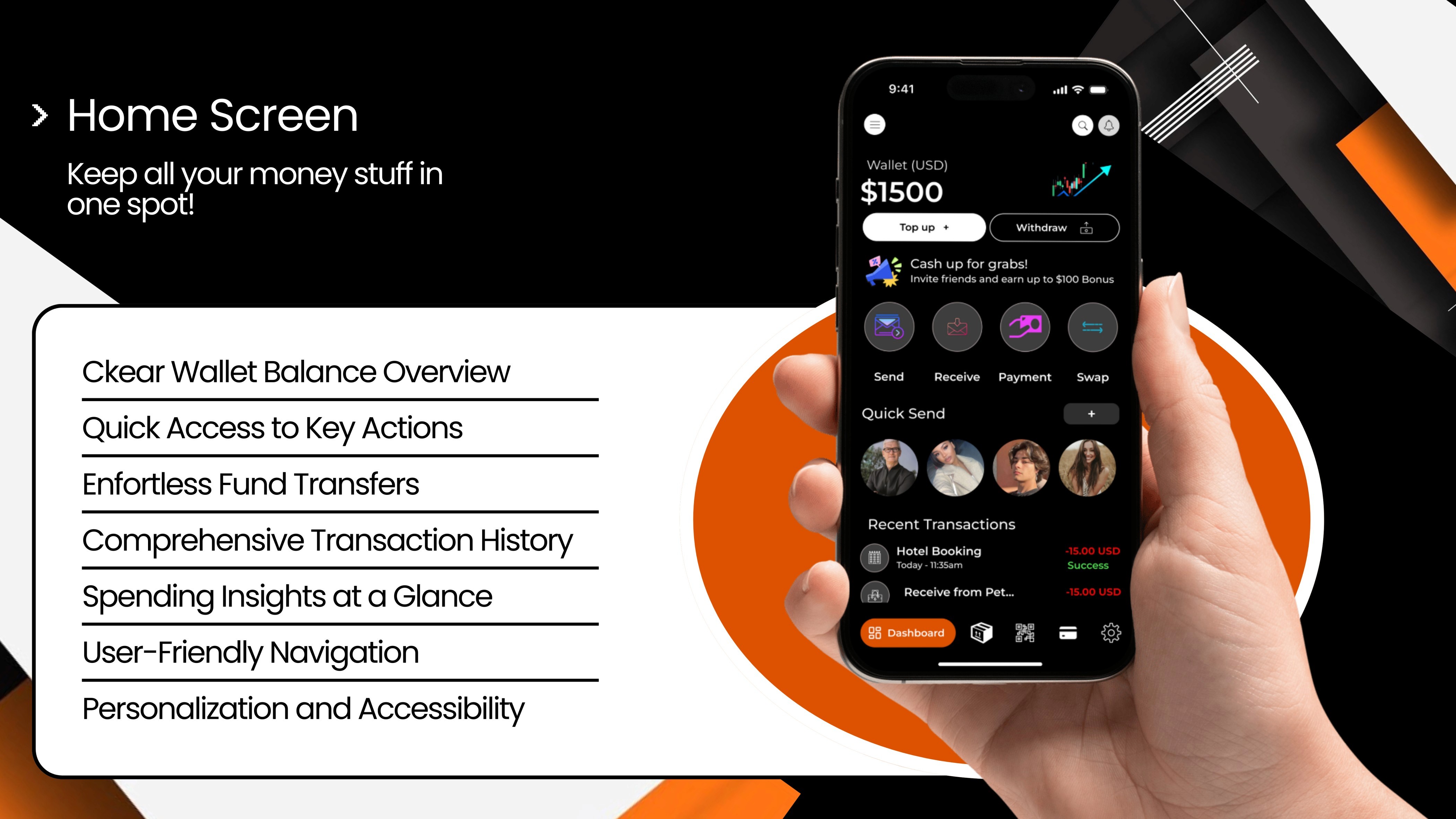

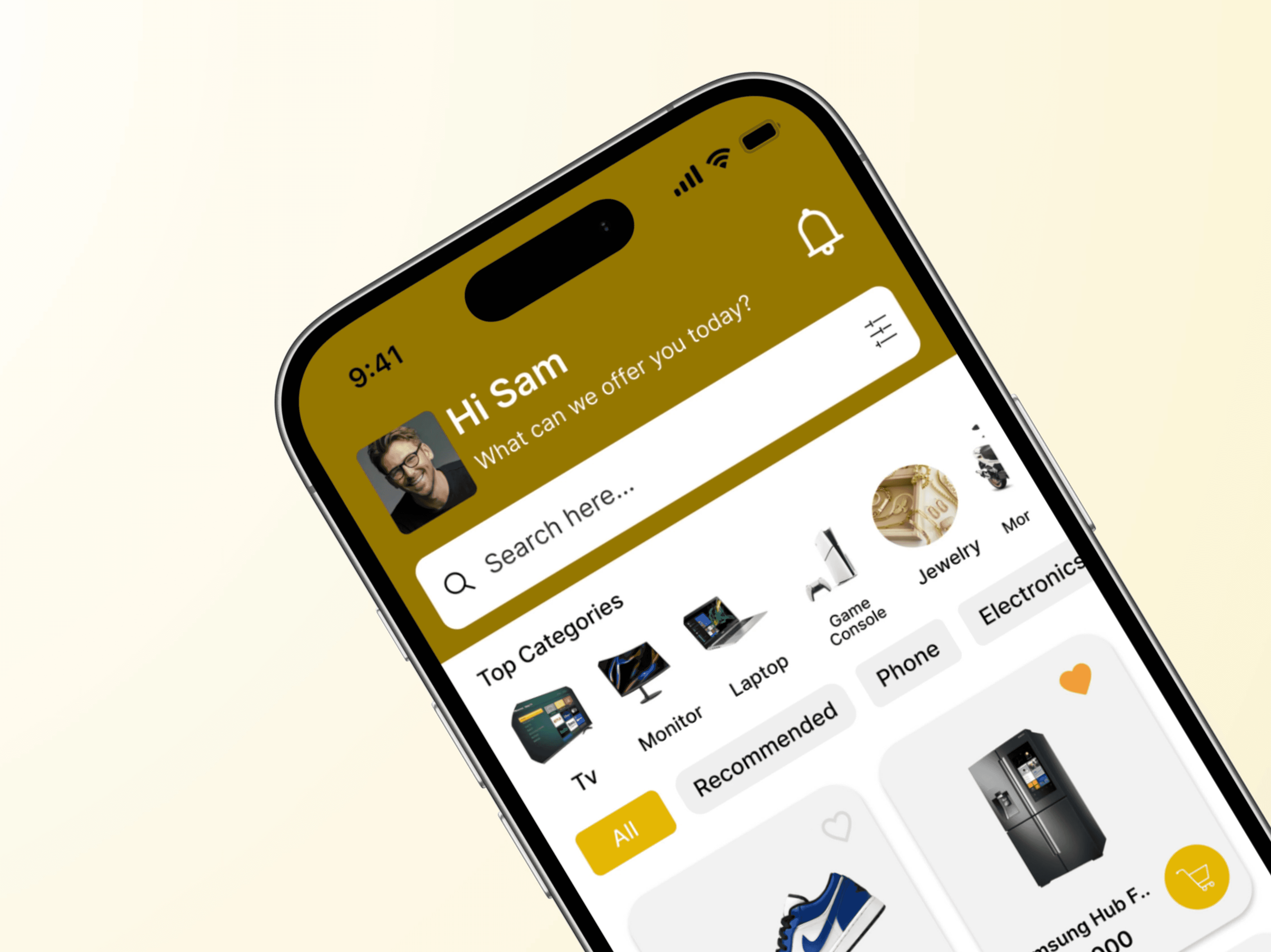

Prime Wallet App

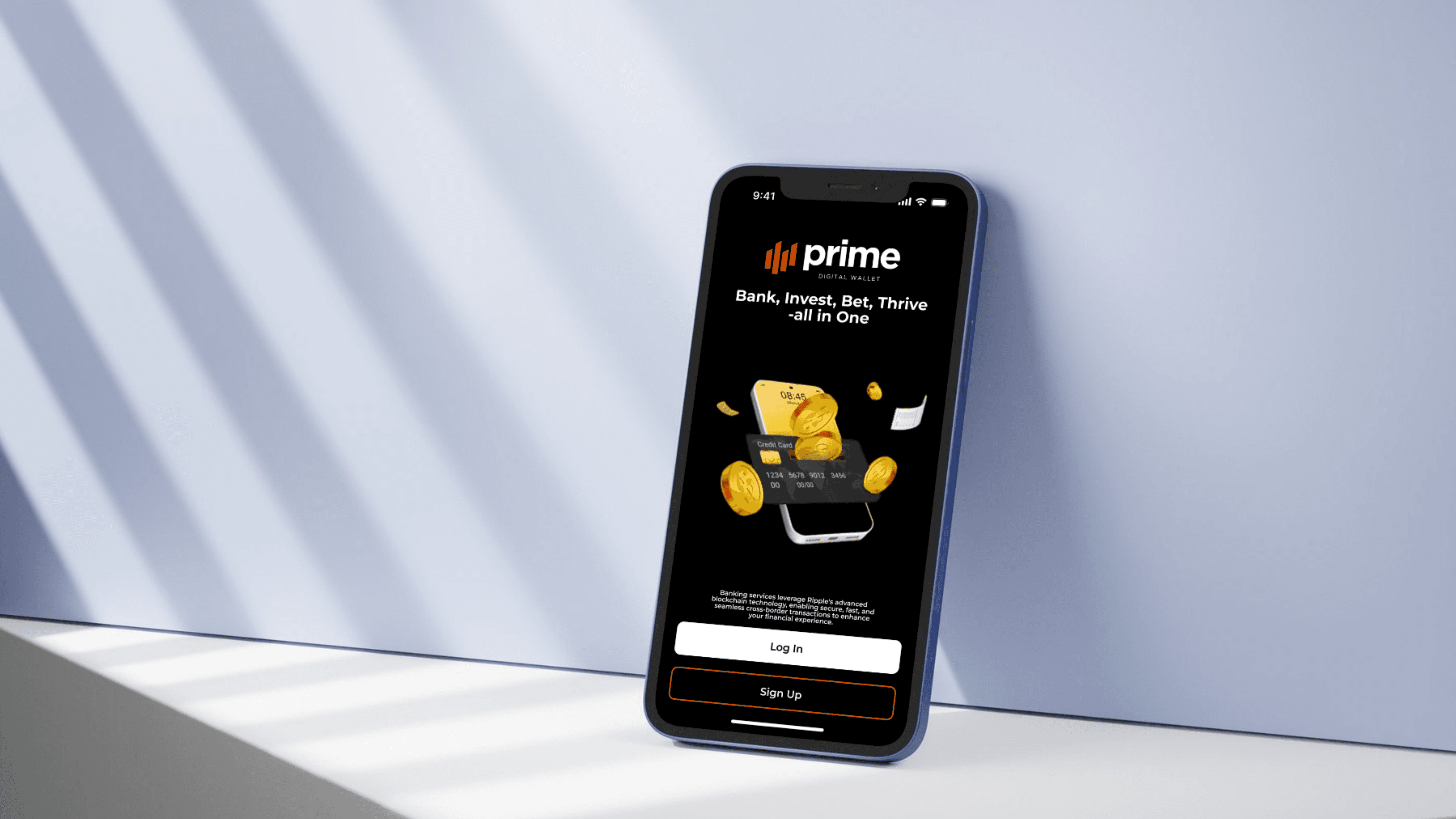

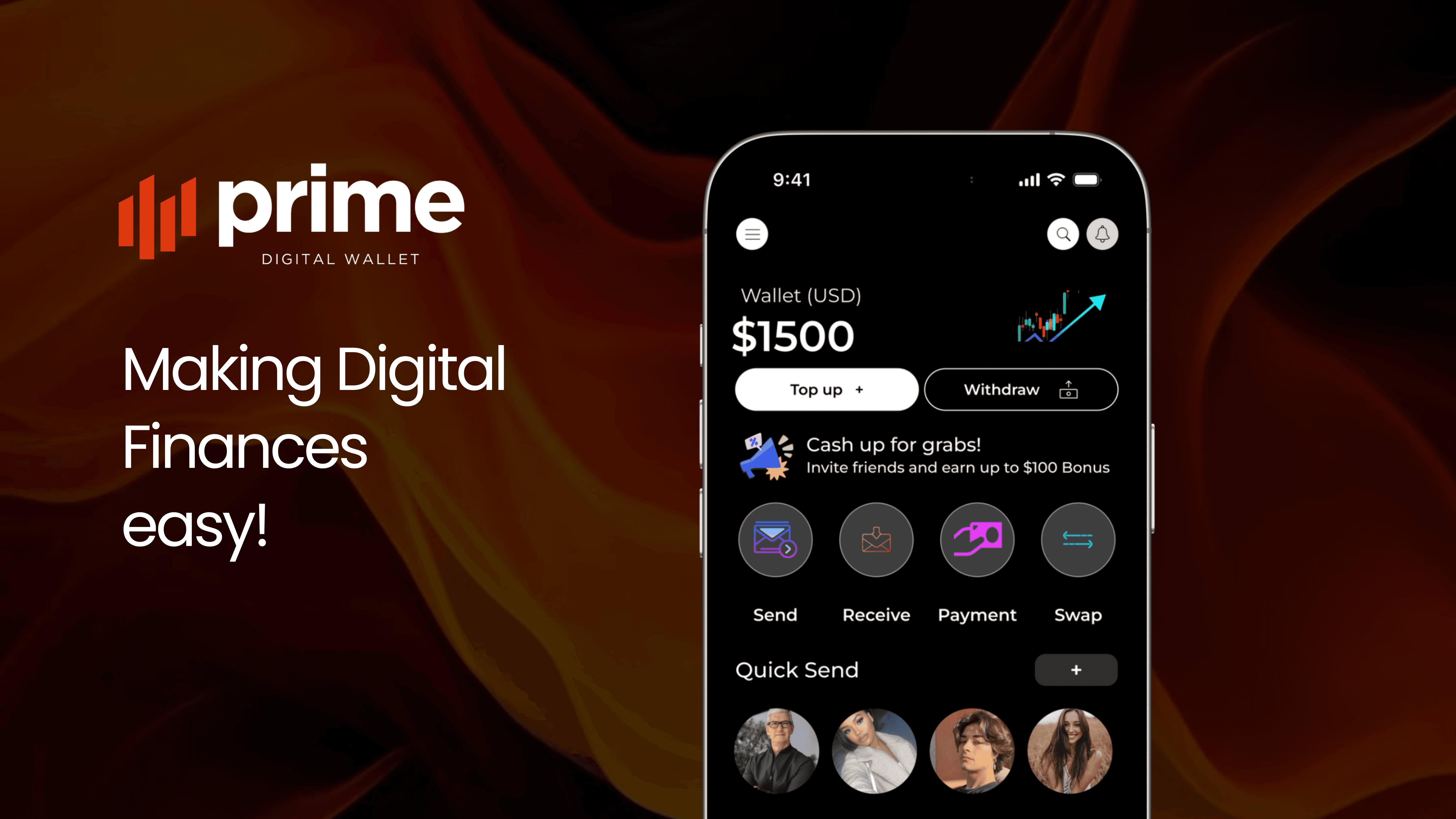

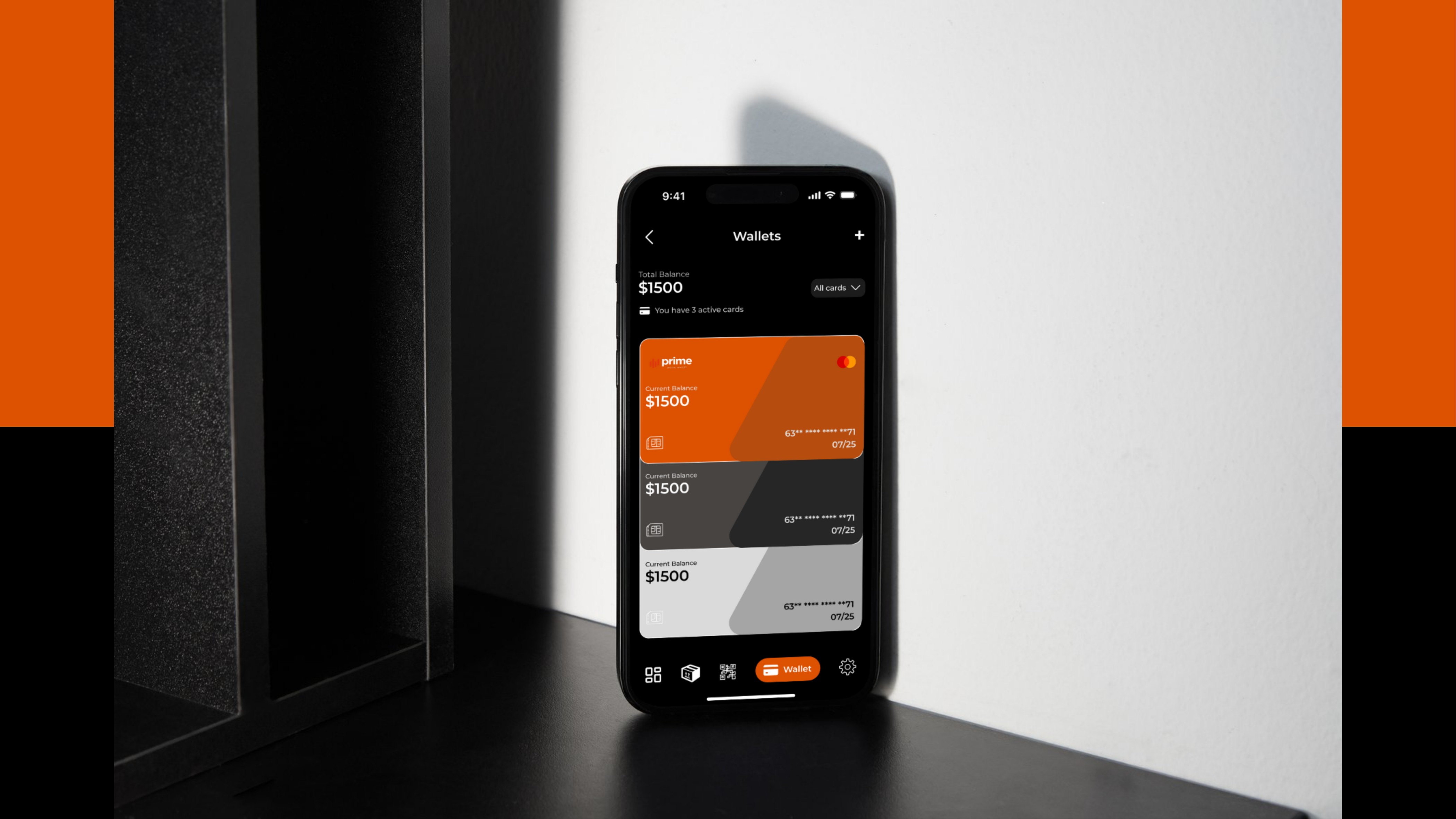

Designed an intuitive and appealing mobile experience that simplifies financial management while offering essential features like fund transfers, bill payments, spending insights and security enhancements.

Role

UX/UI Designer

Industry

Fintech

Duration

3 months

Stage 3. Prototype & Test - Presentation of Designs

This final phase turns ideas into tangible, testable designs.

Steps include:

High-Fidelity Prototypes: Interactive mockups built in tools like Figma or Framer, showcasing real UI components and flows.

User Testing: Conducting usability tests with actual or potential users to gather feedback on the experience, clarity, and satisfaction.

Iteration: Refining based on insights — improving navigation, reducing cognitive load, or rethinking interactions that felt confusing.

The goal here is to validate the solution before development — ensuring the design not only looks good but truly solves the user's problem.